How to Tag Your Google Ads to Track in PayHelm

This article focuses on Google Ads, but the same logic applies to all advertising platforms.

Understanding URL Parameters

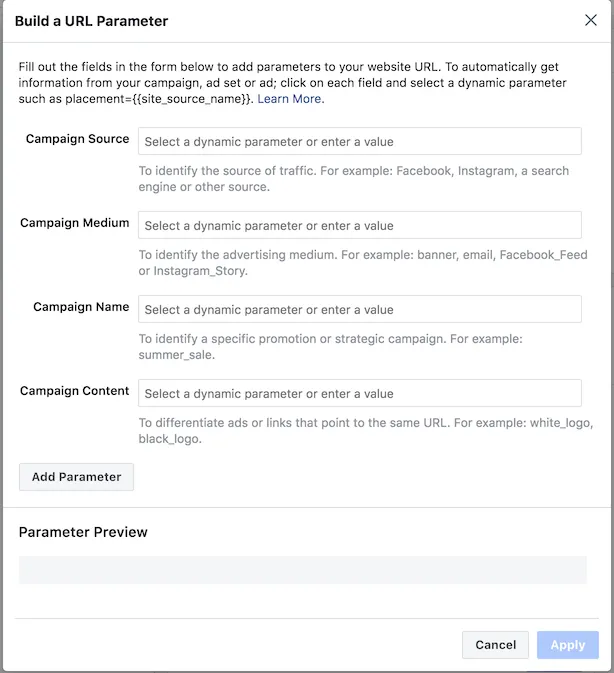

URL parameters are pieces of information added to the end of a web address (URL) to pass data about the user’s activity or the source of traffic. They are commonly used in marketing, analytics, and development to track and personalize user experiences.

URL parameters help you measure how effective your ads are. They show where your ad traffic comes from and which ads drive conversions. For example, URL parameters reveal which link was clicked to reach your website or Facebook Page.

Structure of URL Parameters

Parameters are added to a URL after a question mark (?) and consist of key-value pairs separated by an equals sign (=). If there are multiple parameters, they are separated by an ampersand (&).

Example URL with Parameters:

https://www.example.com?utm_source=google&utm_medium=paidads&campaign=spring_sale

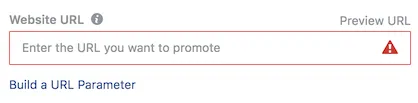

How to Add URL Parameters in Google Ads

Follow these steps:

- Create or edit a campaign:

- Start a new campaign or continue editing a draft in Google Ads.

- Go to the Ad level:

- After completing the Campaign and Ad Group levels, move to the Ad level.

- Click the ad in the ad group in question to edit it, scroll down to the Final URL field.

- Enter your parameters:

- You can add parameters directly to the Final URL field.

- If you have

utm_source=1in the Final URL field andutm_source=2in the URL Parameters field, the Final URL will useutm_source=2.

- Define your parameters:

- Each parameter consists of a key (e.g., “background”) and a value (e.g., “blue”), connected with an equals sign (

=). - Separate multiple parameters with an ampersand (

&).

- To track an ad with a blue background:

- Add

background=blue. - The Final URL might look like:

www.example.com?background=blue.

- Add

- Each parameter consists of a key (e.g., “background”) and a value (e.g., “blue”), connected with an equals sign (

- Avoid empty parameters:

- Always include a value for each key.

- Example of incorrect usage:

www.example.com/page?background=&foo=bar. - Correct usage:

www.example.com/page?background=blue&foo=bar.

- Save your changes:

- Click Save to save. The URL parameter will appear in the field.

Recommended Tags to Use for Google Ads to Track in PayHelm

We recommend using the following tags on your links to track:

- utm_medium=paidads

- utm_source=google

- utm_campaign={campaignid}

- utm_content={creative}

- utm_id={campaignid}